Find out what to do if you are a victim of identity theft or have an overpayment of your benefits. Here is the list of necessary information for all of the states’ 1099g. Find out how to check, reissue, or donate your colorado tax refund.

Arizona Form 1099 g State Form

Learn about identity verification, validation key, and intercepted refunds.

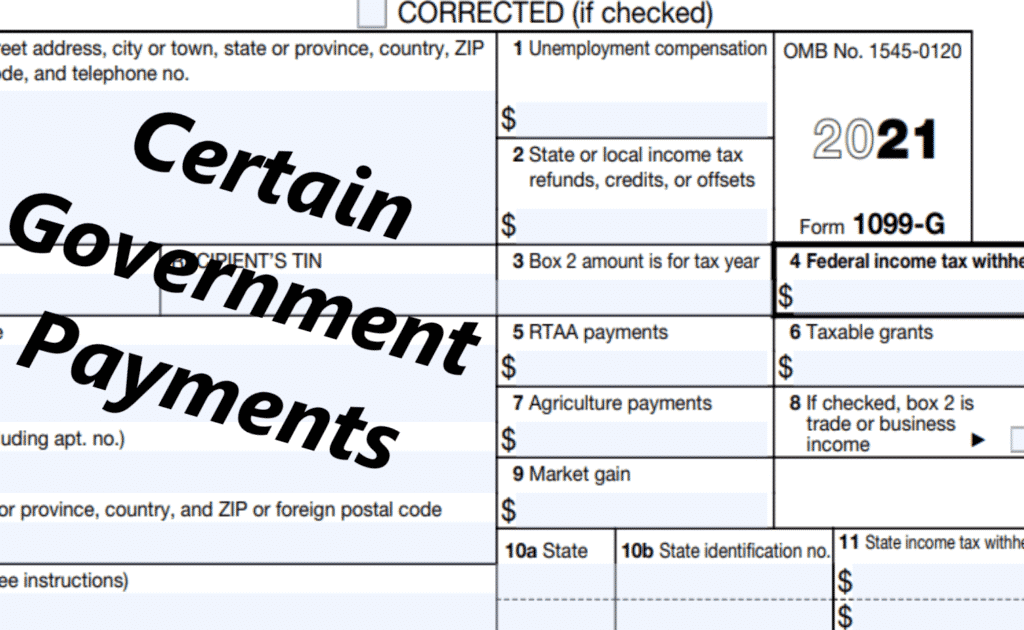

Under the tax benefit rule, if a taxpayer received a benefit from deducting state and local taxes in a prior year, any refund must be reported as income.

Follow the steps for box 2 amounts, total payments, and tax year of refund. Find out how to request corrected 1099s and where to submit them electronically or by paper. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Thank you very much for your help.

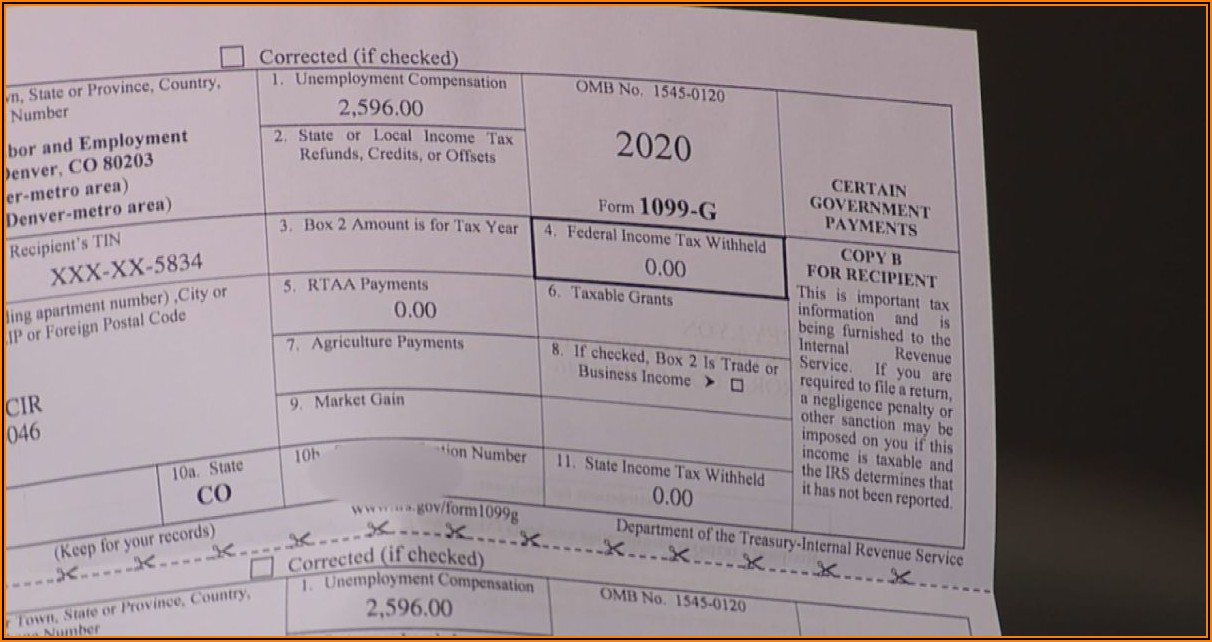

If you itemized deductions on your federal return in the same year that you received the state or local refund, the refund may be considered taxable income. If you believe your tax identification number has been stolen and someone has filed a colorado tax return under your social security number (ssn), please fill out the report possible tax refund fraud form. State or local income tax refunds, credits, or offsets. This is done with a line item on the state income tax return, and paid out together with the taxpayer's income tax refund (or credited to their income tax liability).

However, the tabor refund is actually characterized as a refund of state sales tax.

See for instance line 33 of colorado 2022 form dr 0104: The state adjusted your tax refund (for some reason) and actually only sent you $570. It's also possible that they adjusted your refund, but ended up paying you interest on the amount so it was close to what you expected to receive. Under the tell us about your refund page it asks for the total of all your payments and withholding. in the list from the link what does this include? does amounts withheld on your 1099 mean t

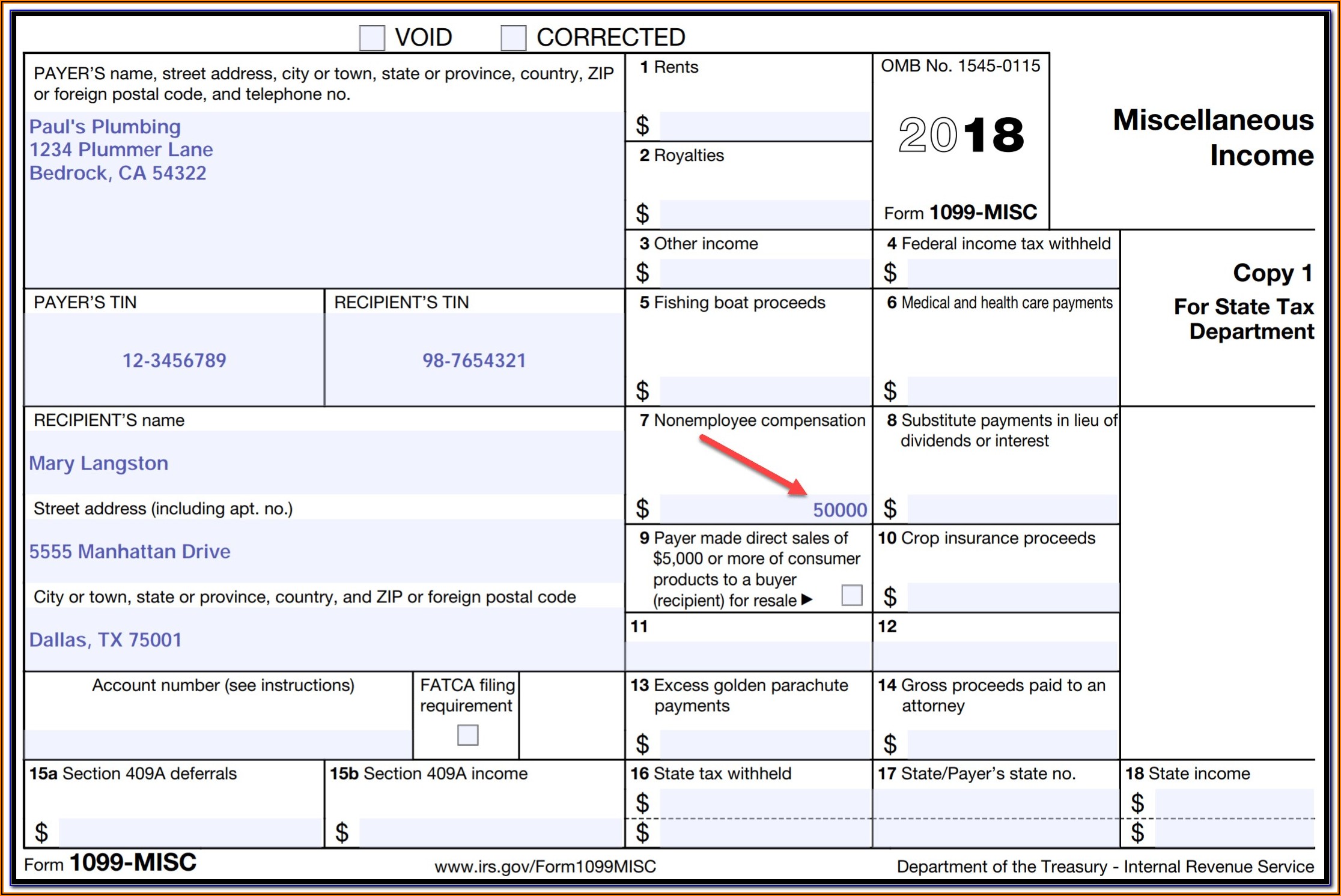

We would like to show you a description here but the site won’t allow us. Turbotax has prefilled the amount of the refund i see on my 2023 colorado individual income tax return form. Frequently clients don’t bring us the 1099gs for the state refunds and we are held up waiting to get the eins and addresses that would appear on the 1099gs.