George Wallace’s recent warning to Elon Musk about financial matters has sent ripples through the business world. The debate centers on how Musk’s bold financial decisions could impact economic stability. This article dives deep into Wallace’s concerns, unpacking the potential consequences and offering insights into the financial landscape in a way that’s easy to grasp.

Let’s face it—Elon Musk is a titan in today’s business world. His name alone commands attention, whether it’s for launching rockets, revolutionizing electric vehicles, or shaking up social media. But lately, George Wallace, a seasoned economist and financial guru, has stepped forward with some serious concerns about Musk’s financial strategies. Wallace’s warnings aren’t just about Musk’s ventures; they’re about the broader financial ecosystem and what could happen if things go sideways. This article will break it all down for you, offering clarity and context to help you understand the stakes.

Our goal here is simple: to provide a clear, comprehensive look at George Wallace’s perspective. We’ll explore the financial implications of Musk’s decisions, offering a balanced view of the potential consequences. Whether you’re an investor, a tech enthusiast, or just someone curious about how the global economy works, this article aims to spark informed discussions that matter.

Read also:Where Was Sade Baderinwa Unveiling The Journey Of A Rising Star

Table of Contents

- Who is George Wallace?

- The Financial Landscape Today

- Elon Musk’s Bold Financial Moves

- Why Wallace Is Worried About Musk’s Strategies

- What Could Happen Next?

- A Global View of Financial Stability

- How the Markets Are Reacting

- Lessons from the Past

- What Can Be Done?

- Wrapping It Up

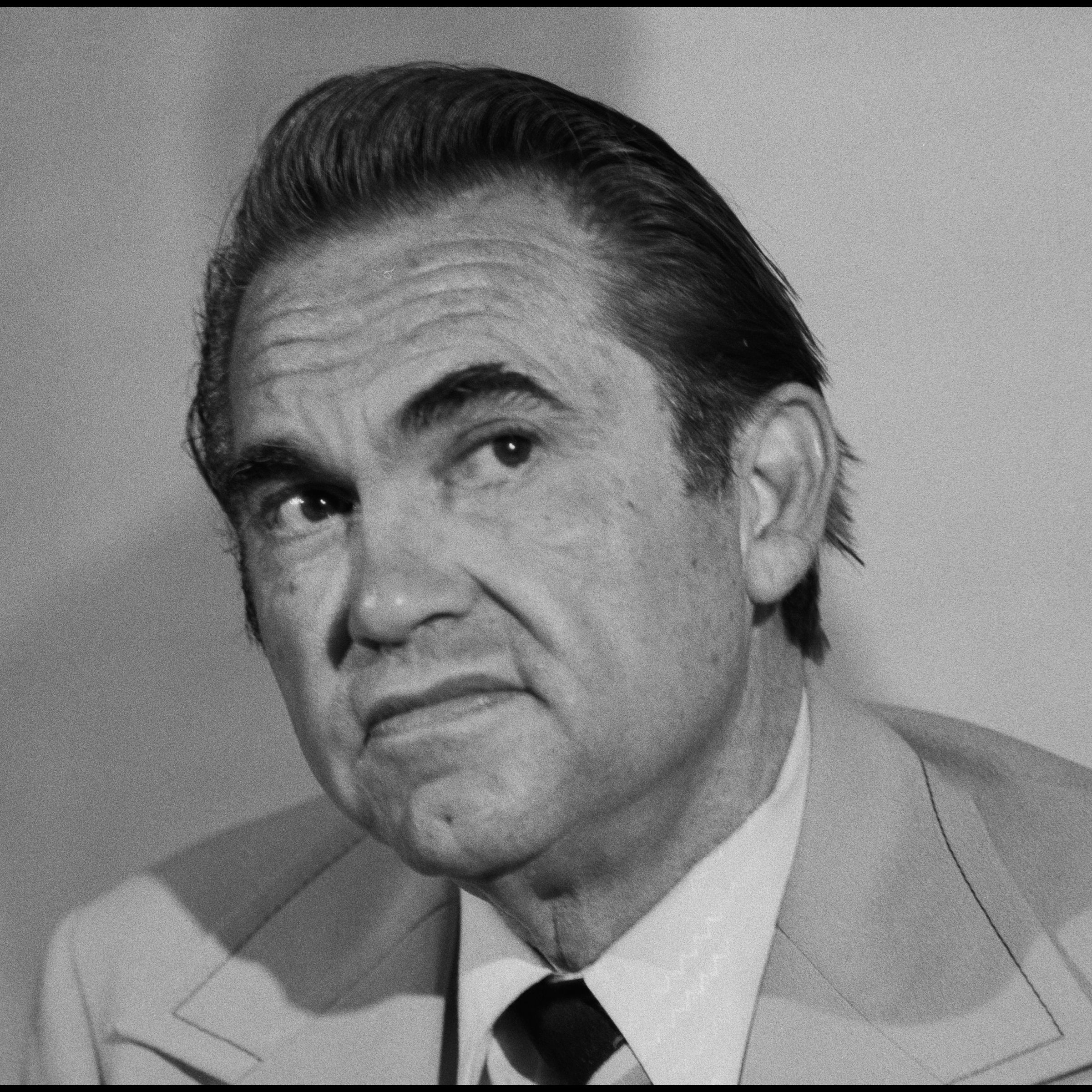

Who is George Wallace?

Before we dive into the nitty-gritty, let’s get to know George Wallace. He’s not just another talking head in the finance world—he’s a heavyweight economist with decades of experience under his belt. Wallace has spent years studying global financial systems, teaching at top universities, and advising major corporations. His work is respected worldwide, and his insights often shape the way people think about economic policy and market dynamics.

Personal Data and Biodata

| Full Name | George Wallace |

|---|---|

| Occupation | Economist, Financial Analyst |

| Field of Expertise | Global Economics, Financial Stability |

| Education | Ph.D. in Economics, Harvard University |

| Notable Works | "The Future of Financial Markets," "Economic Stability in the Digital Age" |

Wallace’s research and publications have earned him a reputation as a trusted voice in the world of finance. His ability to connect the dots between global trends and individual financial decisions makes him uniquely qualified to weigh in on Musk’s strategies.

The Financial Landscape Today

To fully grasp why George Wallace is ringing the alarm bells, we need to zoom out and look at the bigger picture. The global economy is going through a rough patch right now. Inflation is running wild in many countries, geopolitical tensions are flaring up, and technology is reshaping the way we think about money. It’s a perfect storm of challenges that makes financial decision-making more complex than ever.

Key Financial Trends

- Inflation has become a major concern, with prices skyrocketing in key sectors like energy and food. This is squeezing consumers and businesses alike.

- Central banks around the world are scrambling to adjust their policies, trying to balance economic growth with price stability. It’s a delicate dance, and mistakes could have serious consequences.

- Cryptocurrencies and other digital assets are gaining traction, challenging traditional financial systems. While some see this as progress, others worry about the risks these new technologies bring.

This context is crucial because it sets the stage for Wallace’s critique of Musk’s financial moves. In a world already fraught with uncertainty, bold strategies can have far-reaching effects.

Elon Musk’s Bold Financial Moves

There’s no denying that Elon Musk has a knack for thinking big. Whether it’s building electric cars, launching rockets, or buying Twitter, Musk isn’t afraid to take risks. His ventures have not only disrupted industries but also introduced new ways of thinking about finance.

Notable Financial Moves

- Musk’s decision to invest heavily in cryptocurrencies, particularly Bitcoin, was a game-changer. By positioning Tesla as a leader in digital asset adoption, he put the company—and himself—at the center of the crypto conversation.

- His expansion into space exploration with SpaceX is another bold move. It’s a high-stakes gamble that requires massive investments and financial innovation. But if it pays off, the rewards could be astronomical.

- Then there’s the Twitter acquisition, which raised eyebrows across the board. Critics have questioned whether the deal was financially sustainable, especially given Musk’s other commitments.

While Musk’s strategies have earned him admiration from many, they’ve also drawn criticism from experts like George Wallace. The question is: Are these moves visionary or reckless?

Read also:Unveiling Virginia Lewsader A Closer Look At Her Life Career And Impact

Why Wallace Is Worried About Musk’s Strategies

George Wallace isn’t just sounding the alarm for fun—he has legitimate concerns about Musk’s financial decisions. His warnings highlight specific risks that could have ripple effects across the economy.

Risk Factors

- Musk’s reliance on volatile digital assets like Bitcoin could destabilize his companies’ finances. If the value of these assets drops suddenly, it could lead to serious cash flow problems.

- His aggressive expansion into high-risk ventures, such as space travel, could strain financial resources. These projects require enormous amounts of capital, and setbacks could be costly.

- Lack of transparency in financial dealings is another red flag. Investors need clear, reliable information to make informed decisions. Without it, confidence in Musk’s ventures could erode over time.

Wallace argues that while Musk’s innovations are exciting, they need to be managed carefully to ensure long-term success. It’s not just about taking risks—it’s about managing them responsibly.

What Could Happen Next?

Musk’s financial decisions don’t exist in a vacuum. They have the potential to affect the broader economic landscape in significant ways. Wallace’s warnings highlight several areas of concern that are worth paying attention to.

Areas of Concern

- Market volatility could increase as investors react to Musk’s high-profile moves. This could create uncertainty and make it harder for businesses to plan for the future.

- Investor sentiment could shift, influencing where capital flows and how markets behave. If enough people lose faith in Musk’s strategies, it could have a domino effect.

- Regulatory scrutiny could intensify as governments and watchdogs take a closer look at corporate finances. This could lead to stricter rules and more oversight, which might impact how companies operate.

Understanding these potential impacts is essential for anyone trying to navigate the complexities of modern finance. It’s not just about one person or one company—it’s about the bigger picture.

A Global View of Financial Stability

Wallace’s warnings aren’t just about Elon Musk—they’re part of a larger conversation about financial stability in an interconnected world. Decisions made by influential figures like Musk can have far-reaching consequences, especially in today’s global economy.

Global Financial Trends

- Emerging markets are increasingly influenced by the financial strategies of major corporations. What happens in Silicon Valley doesn’t stay in Silicon Valley—it ripples across the globe.

- Regulatory frameworks are evolving to address new challenges, such as the rise of cryptocurrencies and the growing importance of tech companies. This is a work in progress, and the rules are still being written.

- Collaboration among global financial institutions is more important than ever. Only by working together can we hope to maintain stability in an ever-changing world.

Wallace’s analysis reminds us that responsible financial stewardship isn’t just a nice idea—it’s a necessity in today’s interconnected economy.

How the Markets Are Reacting

Wallace’s warnings haven’t gone unnoticed by the markets. Investors and analysts are paying close attention, trying to gauge the potential impact on their portfolios. The reactions have been mixed, reflecting the ongoing debate about Musk’s role in shaping financial markets.

Market Dynamics

- Stock prices for Musk’s companies have shown signs of volatility since Wallace’s comments hit the news. Some investors are spooked, while others see opportunities in the chaos.

- Analysts are revisiting their projections, incorporating Wallace’s concerns into their models. This is a sign that his warnings are being taken seriously, even if they’re not universally accepted.

- Investor sentiment remains divided, with some viewing the warnings as a call for caution and others dismissing them as overly pessimistic. It’s a classic case of differing perspectives colliding.

These reactions underscore the complexity of the situation. There’s no easy answer, and the debate is far from over.

Lessons from the Past

History has a way of repeating itself, and Wallace’s warnings draw parallels to past financial crises. By learning from these experiences, we can better understand the risks and opportunities ahead.

Key Historical Examples

- The dot-com bubble of the late 1990s taught us about the dangers of speculative investments. When the bubble burst, many companies went under, and investors lost billions.

- The 2008 financial crisis was a wake-up call about the perils of excessive risk-taking. It showed us that when things go wrong, the consequences can be catastrophic.

- Regulatory reforms following these events emphasized the importance of prudent financial management. They reminded us that rules matter, even in a rapidly changing world.

By studying these precedents, we can appreciate why Wallace’s warnings are so important—and why responsible financial practices are essential.

What Can Be Done?

To address the concerns raised by George Wallace, several solutions and recommendations have been put forward. These aim to ensure the long-term sustainability of Musk’s ventures while promoting broader economic stability.

Strategic Recommendations

- Enhance transparency in financial dealings to build trust with investors. People need to know what’s going on behind the scenes to feel confident in their investments.

- Diversify investment portfolios to reduce exposure to volatile assets. This can help mitigate risks and provide a safety net during turbulent times.

- Engage in constructive dialogue with regulators to align corporate strategies with broader economic goals. Working together can lead to better outcomes for everyone involved.

Implementing these recommendations could help reduce the risks associated with Musk’s financial decisions, paving the way for a more stable financial environment.

Wrapping It Up

George Wallace’s warnings about Elon Musk’s financial decisions highlight critical issues that deserve our attention. By examining the broader financial context, understanding the implications of Musk’s strategies, and learning from history, we can make smarter, more informed decisions. This isn’t just about one person or one company—it’s about the health and stability of the global economy.

We invite you to join the conversation by sharing your thoughts and insights. Your voice matters in shaping the discourse around financial decision-making and its impact on the world. And while you’re here, check out other articles on our site to deepen your understanding of these complex and fascinating issues.