When it comes to the world of finance, the 10-year treasury is more than just a buzzword—it’s a cornerstone of the global economy. Think of it as the heartbeat of financial markets, influencing everything from mortgage rates to stock prices. It’s like that one friend who always knows what’s going on, but instead of gossip, it’s all about interest rates and economic health. So, if you’ve ever wondered why everyone talks about the 10-year treasury, you’re in the right place. Let’s dive in and break it down in a way that even your grandma could understand.

The 10-year treasury is essentially a government bond issued by the U.S. Department of the Treasury. It’s like a loan you give to the government, and they promise to pay you back with interest over 10 years. Sounds simple, right? But don’t be fooled—this little bond packs a punch in the world of finance. It’s a benchmark for interest rates, influencing everything from car loans to credit cards.

Now, you might be wondering, “Why does everyone care so much about this bond?” Well, buckle up, because the 10-year treasury isn’t just a financial instrument—it’s a crystal ball for the economy. It tells us whether people are optimistic about the future or if they’re worried about a potential downturn. So, whether you’re an investor, a homeowner, or just someone curious about how the economy works, understanding the 10-year treasury is a game-changer.

Read also:Cheryl Ladd The Iconic Journey Of A Hollywood Legend

Table of Contents

- What is the 10-Year Treasury?

- Why is the 10-Year Treasury Important?

- How Does the 10-Year Treasury Work?

- Key Factors Influencing the 10-Year Treasury

- Market Impact of the 10-Year Treasury

- The 10-Year Treasury from an Investor’s Perspective

- Historical Performance of the 10-Year Treasury

- Risks and Rewards of Investing in the 10-Year Treasury

- Future Trends in the 10-Year Treasury Market

- Conclusion: Why You Should Care About the 10-Year Treasury

What is the 10-Year Treasury?

Alright, let’s get real for a sec. The 10-year treasury is basically a bond issued by Uncle Sam—yes, the U.S. government. When you buy one of these bonds, you’re essentially loaning money to the government for 10 years. In return, they promise to pay you back with interest. It’s like that old-school savings bond your grandparents used to talk about, but way cooler and more impactful.

Breaking It Down

Here’s the thing: the 10-year treasury isn’t just any bond. It’s a benchmark for long-term interest rates. Think of it as the gold standard in the world of finance. Investors, economists, and even politicians pay attention to it because it gives a clear picture of where the economy might be headed. If the yield on the 10-year treasury is high, it could mean people are optimistic about the future. If it’s low, well, that might signal some trouble ahead.

Now, here’s the kicker: the 10-year treasury yield is like a thermometer for the economy. It tells us whether people are feeling good about things or if they’re getting a little nervous. And guess what? That little number can move markets in a big way.

Why is the 10-Year Treasury Important?

Let’s face it: the 10-year treasury is a big deal. Why? Because it affects pretty much everything in the financial world. From mortgage rates to stock prices, this bond has its fingers in a lot of pies. It’s like that one guy at the office who knows everyone and everything—he’s connected to everything that matters.

Impact on Interest Rates

One of the biggest reasons the 10-year treasury is so important is because it sets the tone for interest rates. When the yield goes up, it usually means borrowing costs will rise too. That means mortgages, car loans, and even credit card rates could go up. On the flip side, if the yield drops, borrowing becomes cheaper, which can be a boon for consumers and businesses alike.

Global Influence

But wait, there’s more! The 10-year treasury isn’t just a U.S. thing. It has a global impact too. Investors all over the world look to the U.S. Treasury market as a gauge for economic health. So, when the yield moves, it can send ripples across international markets. Think of it as the financial equivalent of dropping a rock in a pond—the effects are felt far and wide.

Read also:Best Raspberry Pi Remote Iot Software For Android Unlocking Your Smart Future

How Does the 10-Year Treasury Work?

Okay, so we’ve established that the 10-year treasury is a big deal, but how exactly does it work? Let’s break it down in simple terms. When the U.S. government needs money, it issues bonds. These bonds are like IOUs that say, “Hey, lend us some cash, and we’ll pay you back with interest in 10 years.”

Buying and Selling

Now, here’s where it gets interesting. Once these bonds are issued, they don’t just sit there. They’re traded on the open market, just like stocks. That means their price can fluctuate based on supply and demand. And when the price goes up, the yield goes down, and vice versa. It’s like a seesaw—when one side goes up, the other goes down.

So, if you’re an investor, you might buy a 10-year treasury when the yield is high, hoping to lock in a good return. But if the yield drops, the value of your bond could decrease. It’s all about timing and strategy.

Key Factors Influencing the 10-Year Treasury

Alright, let’s talk about what makes the 10-year treasury tick. There are a few key factors that influence its yield, and understanding them can help you make smarter financial decisions.

Economic Growth

One of the biggest factors is economic growth. When the economy is booming, people are more willing to take risks, and they might not be as interested in safe investments like the 10-year treasury. That can drive yields up. But if the economy slows down, people might flock to the safety of government bonds, driving yields down.

Inflation

Inflation is another big player. If prices are rising, investors might demand higher yields to compensate for the loss of purchasing power. It’s like saying, “Yeah, I’ll lend you money, but you need to pay me more because my money won’t be worth as much in the future.”

Federal Reserve Policy

And let’s not forget the Fed. The Federal Reserve plays a huge role in influencing interest rates, and that includes the 10-year treasury yield. If the Fed raises rates, it can push yields higher. If they lower rates, yields might fall. It’s like a game of chess, and the Fed is one of the key players.

Market Impact of the 10-Year Treasury

Now that we’ve covered the basics, let’s talk about how the 10-year treasury impacts the market. It’s like the conductor of an orchestra—everything else follows its lead.

Stock Market

When the 10-year treasury yield rises, it can be a headwind for stocks. That’s because higher yields make bonds more attractive to investors, which can lead to money flowing out of the stock market. On the flip side, if yields fall, stocks might get a boost as investors seek higher returns elsewhere.

Bond Market

And then there’s the bond market itself. The 10-year treasury is the benchmark for other bonds, so its yield can influence everything from corporate bonds to municipal bonds. It’s like the big brother that sets the rules for everyone else.

The 10-Year Treasury from an Investor’s Perspective

So, what does all this mean for investors? Well, it depends on your goals and risk tolerance. If you’re looking for a safe, steady investment, the 10-year treasury might be right up your alley. But if you’re more of a risk-taker, you might want to consider other options.

Risk vs. Reward

Like any investment, the 10-year treasury comes with its own set of risks and rewards. The biggest risk is interest rate risk—if rates rise, the value of your bond could fall. But the reward is a steady stream of income over 10 years, with the backing of the U.S. government.

Diversification

For many investors, the 10-year treasury is part of a diversified portfolio. It’s like having a backup plan in case things go south in other areas of your investments. And who doesn’t love a good backup plan?

Historical Performance of the 10-Year Treasury

Let’s take a quick trip down memory lane and look at how the 10-year treasury has performed over the years. It’s like looking at old photos of your favorite celebrity—some years were great, and some, not so much.

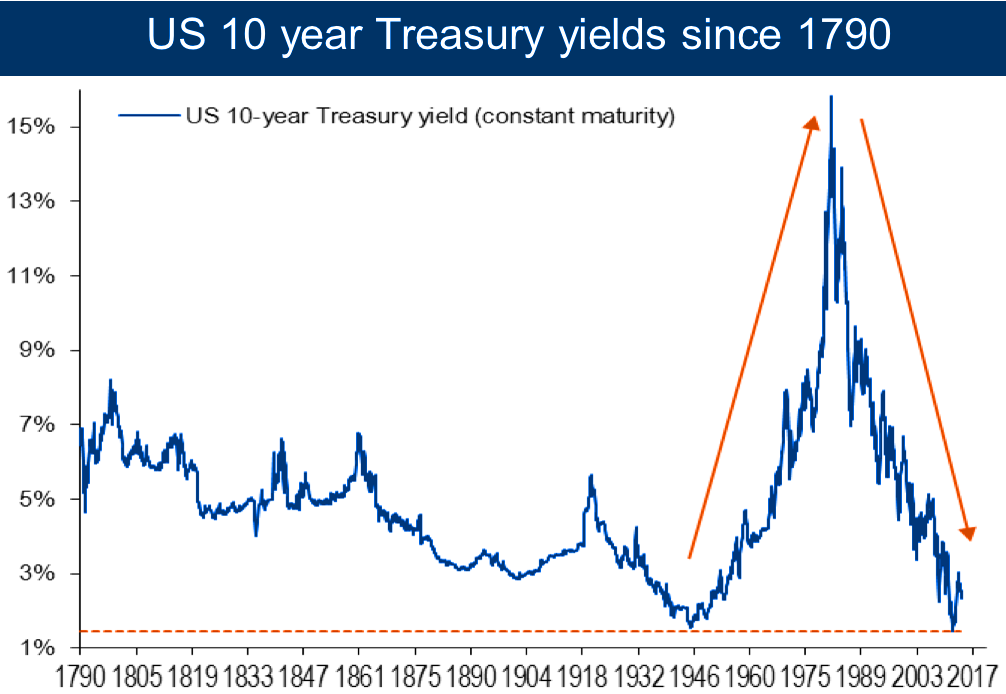

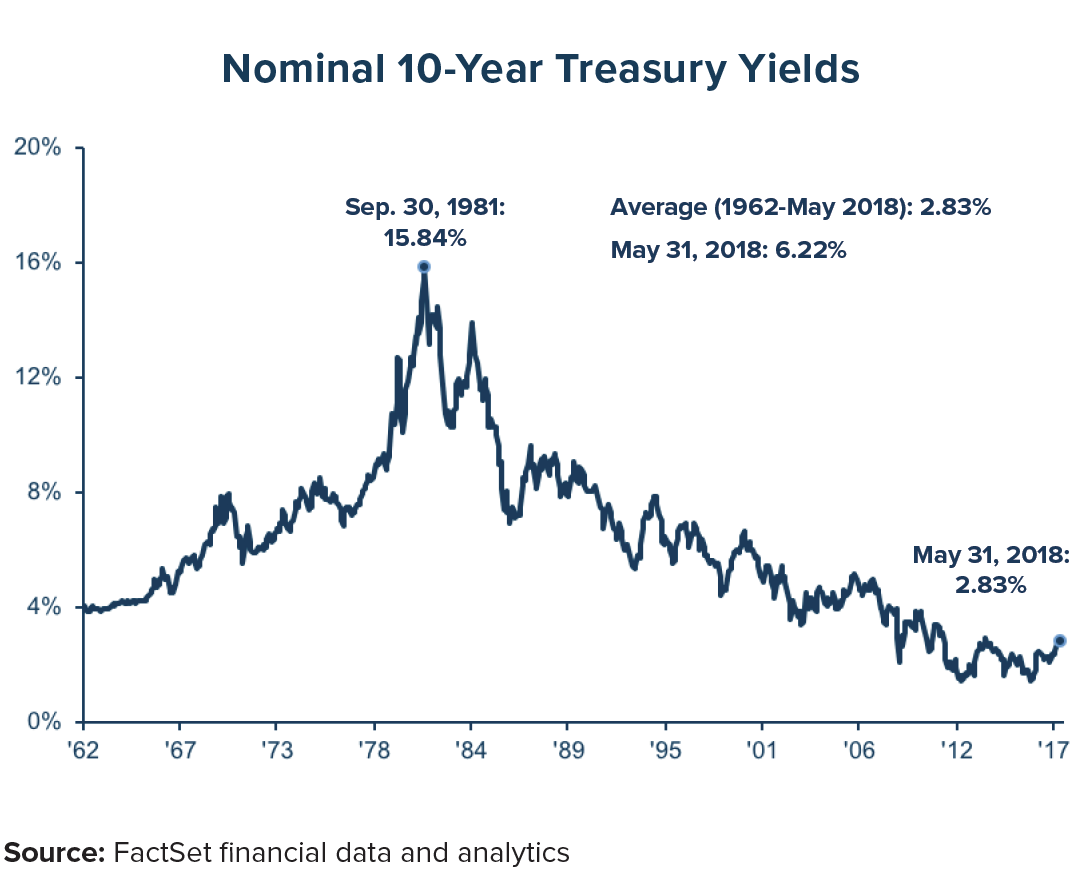

Long-Term Trends

Over the past few decades, the 10-year treasury yield has generally been on a downward trend. That’s partly due to factors like globalization and monetary policy. But there have been spikes and dips along the way, reflecting changes in the economic landscape.

Key Moments

Some key moments in the history of the 10-year treasury include the financial crisis of 2008, when yields plummeted as investors sought safety, and more recent events like the pandemic, which sent yields on a rollercoaster ride. It’s like a movie with lots of plot twists.

Risks and Rewards of Investing in the 10-Year Treasury

Now, let’s get real about the risks and rewards of investing in the 10-year treasury. It’s not all sunshine and rainbows, but it’s not all doom and gloom either.

Risks

As we’ve mentioned, interest rate risk is a big one. If rates rise, the value of your bond could fall. And while the U.S. government is considered a safe bet, there’s always the possibility of unforeseen events that could impact its creditworthiness. It’s like betting on a horse race—there’s always a chance the horse trips.

Rewards

On the flip side, the rewards can be pretty sweet. You get a steady stream of income, and you have the backing of the U.S. government. Plus, it’s a great way to diversify your portfolio and hedge against riskier investments. It’s like having a trusty sidekick in the world of finance.

Future Trends in the 10-Year Treasury Market

So, what’s on the horizon for the 10-year treasury? Well, like any good mystery, there are a few possibilities. Some experts think yields could continue to rise as the economy recovers from the pandemic. Others believe they might stay low for a while, given the current monetary policy environment.

Global Factors

And let’s not forget about global factors. What happens in one part of the world can have a big impact on the 10-year treasury market. Whether it’s geopolitical tensions or economic shifts, these factors can influence yields in ways we might not expect.

Technological Advancements

Then there’s technology. As the world becomes more interconnected, the way we trade and invest in bonds is changing. New platforms and tools are emerging that could make the 10-year treasury market even more accessible and efficient. It’s like watching a sci-fi movie come to life.

Conclusion: Why You Should Care About the 10-Year Treasury

So, there you have it—the 10-year treasury in a nutshell. Whether you’re an investor, a homeowner, or just someone interested in how the economy works, understanding this financial instrument is key. It’s like having a secret weapon in your financial arsenal.

Remember, the 10-year treasury isn’t just a bond—it’s a window into the health of the economy